The state of Connecticut mandates that a sales and use tax as well as a luxury tax be collected per sold item. The Edge can be setup to accommodate this tax scheme, but requires a special POS procedure for processing Trade-Ins and Custom Jobs. The procedure involves a new checkbox added under sales tax at POS; scroll down for the different applicable usage scenarios.

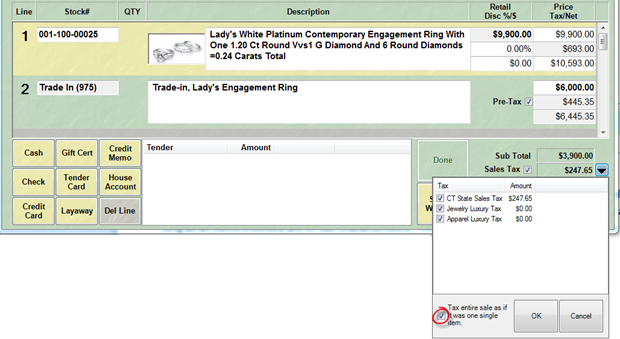

Buy/Trade for Like Merchandise

If you are taking a buy/trade that is being applied to a like-item purchase, you must click the dropdown arrow next to Sales Tax and check the Tax entire sale as if it was one single item checkbox. Multiple trades can be taken against one or more like-item purchases so long as all items involved are of like characteristics. This sale MUST be limited to the trade-in transaction; you cannot mix other types of transactions on this sale.

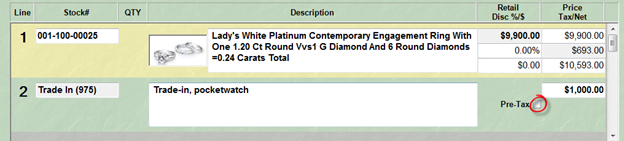

Buy/Trade for Non-Like Merchandise

If you are taking a buy/trade that is being applied to one or more non-like item purchases, you should uncheck the Pre-Tax option on each trade-in saleline.

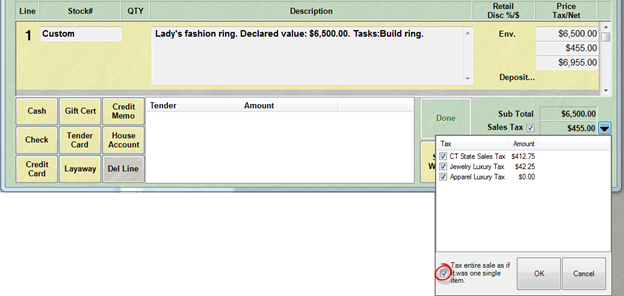

Custom Jobs

The new luxury tax is calculated based on the final selling price of the custom piece. There is no differentiation between labor and parts. When processing a custom job transaction, you must click the dropdown arrow next to Sales Tax and check the Tax entire sale as if it was one single item checkbox. Also, the sale MUST be limited to only the single custom job; you cannot mix other types of transactions on this sale.