Miscellaneous Sale Lines, also known as Miscellaneous Charges (Misc Charge at POS), are a way to define the various miscellaneous types of transactions you might need to accommodate at POS. These include things like coupons or other types of special discounts, non-inventory items, taking cash from the drawer, and more.

Do not rely on Misc Charges for regular sales. They offer extremely limited reporting and will greatly hamper your ability to use the software to maximize your business.

Do not rely on Misc Charges for regular sales. They offer extremely limited reporting and will greatly hamper your ability to use the software to maximize your business.

To work with Misc. Sale Lines:

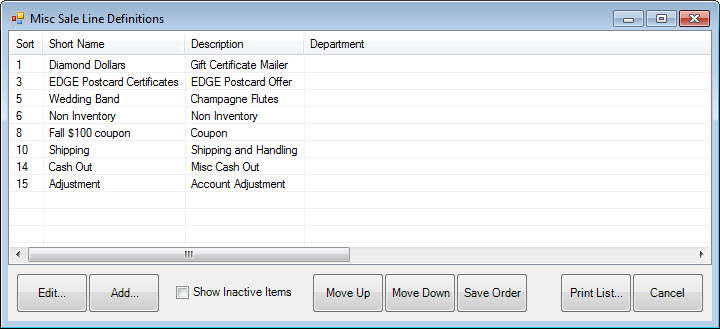

- Click Administrative > Misc Sale Lines. The Misc Sale Line Definitions window will appear.

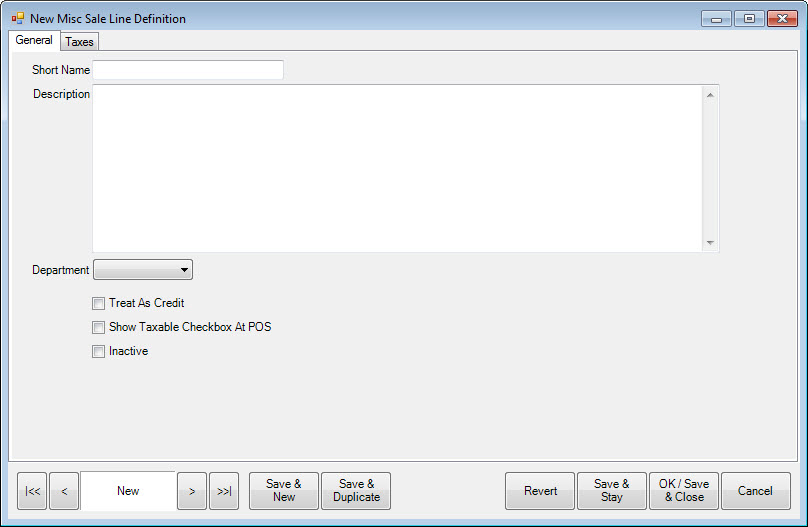

- To add a new line definition, select Add. The New Misc Sale Line Definition window will appear. To change an existing record, select Edit.

The data fields and options for both Add and Edit include:

|

Short Name

|

The name for the definition.

|

|

Description

|

A more detailed description of the definition.

|

| Department |

To include this charge with a specific Department, select it here. |

|

Treat as Credit

|

Whether this line should be treated as a credit.

|

|

Show Taxable Checkbox at POS

|

Whether to allow the option to toggle the tax collection.

|

| Active Round Up |

Use this Misc Charge when rounding up. You can only have one miscellaneous sale line associated with the Round Up feature. |

|

Inactive

|

Indicates that this item is no longer used.

|

- Optionally, visit the Taxes tab and select which taxes to automatically apply at POS.

- Complete the fields as desired and select the appropriate save option from the Record Navigation Bar.