As of July1st, 2022, Colorado has implemented a retail delivery fee on all deliveries by motor vehicle that contain at least one item of tangible property. You can read more about this on the Colorado Department of Revenue site: Retail Delivery Fee

Setup

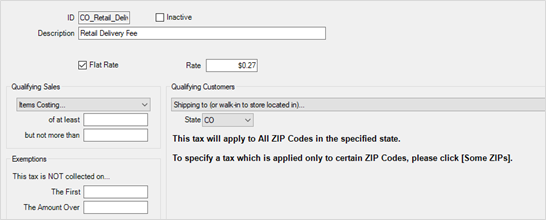

To setup this tax definition:

- Navigate to Administrative > Sales Tax > Tax Definitions and click the Add button at the bottom.

- Enter an ID to label this tax, such as CO_RDF.

- Enter the Description as Retail Delivery Fee.

- Check the Flat Rate box and enter a Rate of $0.29.

- Under Qualifying Customers, set the drop-down to Shipping To (or walk-in to store located in) and select CO as the state.

- Click the Categories tab and make sure all categories are unchecked.

- Click the Stores tab and make sure any applicable stores are checked.

- Click the Other tab and check Shipping.

- Click OK/Save & Close to save your new tax definition, then restart The Edge.

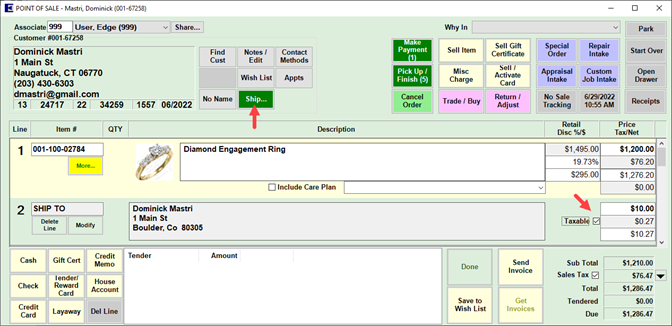

Collection at POS

At POS, this tax will apply when the Ship button is used to ship to an address in Colorado.

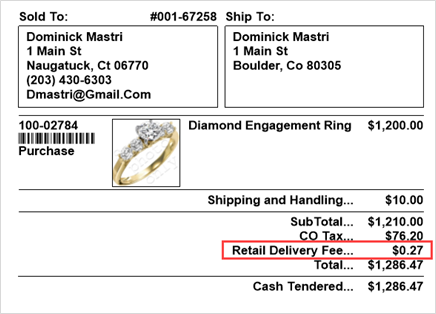

It will also appear on the receipt:

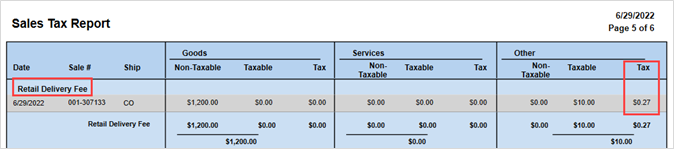

And like all tax definitions, it will be included on your Sales Tax report.

Click here for more information on running the Sales Tax report.