For any state where you determine you have a tax collection obligation you must setup a tax definition:

- Click Administrative > Sales Tax > Tax Definitions.

- Click the Add button.

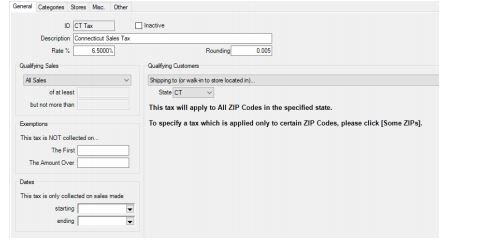

- Specify an ID (abbreviation e.g. CT Tax) and Description (e.g. Connecticut Sales Tax).

- Specify the tax Rate %.

- Rounding sets the threshold at which to round up. Set this to .005 unless your state has special rounding rules.

- Qualifying Sales defaults to All Sales. If your state has specific dollar thresholds for when tax applies, you can set limits using these fields and/or the Exemptions fields.

- Set Qualifying Customers to Shipping to (or walk-in to store located in) and select the state.

- Visit the Categories, Stores, Misc, and Other tabs and check everything this tax should apply to.

- Save your tax definition.