This should be an asset account and is used when an item is marked returned to vendor (RTV). When an item is marked RTV, The Edge is finished with it, so this posting moves the item value from your primary asset account to this temporary sub-asset account. You will have to post your own QuickBooks entries to move assets from this account to other accounts when you receive credit or payment from the vendor for returned items.

Procedures

When you enter a Return to Vendor in The Edge, it debits Inventory RTV and credits Inventory Edge.

When you enter the Invoice in QuickBooks, debit Accounts Payable and credit InventoryRTV.

To do so:

- To find items returned in The Edge, go to Administrative > QuickBooks > G/L report.

a. Select the date.

b. Group by G/L Account.

c. Select Posted Items and Voided Sales.

d. Select OK.

- Look for a balance in the Inventory RTV account.

- Now we run a report to find the items returned and to whom they were returned. Go to Reports > Inventory > In Stock by Category.

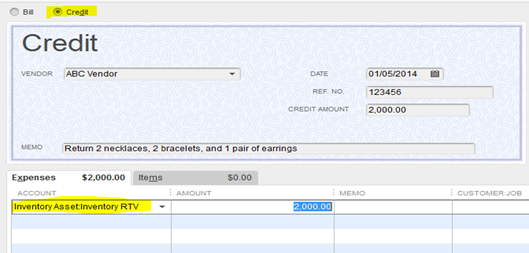

- To enter a credit payable, go to QuickBooks > Vendors > Enter Bill.

a. Select Credit instead of Bill.

b. Select the vendor.

c. Enter the date of the credit.

d. Enter the amount of the credit.

e. Select Inventory Asset Inventory RTV for the account.

- Save and close.