This account is used to manage bank deposits. With daily QuickBooks posting, all your individual deposits will flow through to QuickBooks.

- Gather together your cash, checks, and your credit card settlement statement from your credit card terminal.

- To find out what transactions generated undeposited funds, in The Edge, go to Administrative > QuickBooks > G/L Report.

a. Set the date for which you would like to see the report.

b. Select Posted Items, Voided Sales, and group by GL Account.

c. Click OK. That will show the deposits to be made.

- To find out how the denominations were recorded into QuickBooks, run the Daily Activity report, Go to Reports > Activity > Daily.

a. Enter the same date.

b. Select Show Trades as Tender, you do not need Show Details, Page Breaks or group by the date.

c. Select OK.

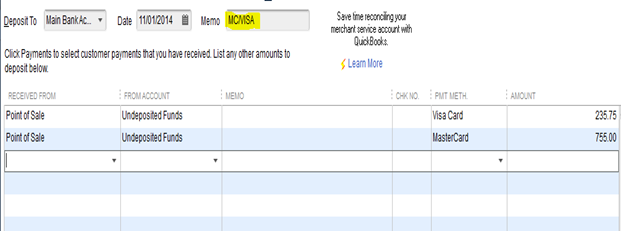

- In QuickBooks, go to Banking > Make Deposit.

- Select the bank account, enter date of deposit, and in the memo line, select Cash/Checks, MC/VISA, AMEX, Discover, etc. You should deposit your money in QuickBooks in the same way that it will appear on your bank statement for an easy bank reconciliation process.

- After making your deposit, your Undeposited Funds balance should be $0. Check this by going to QuickBooks > Lists > Chart of Accounts. Look at Undeposited Funds to make sure it is $0. If it is not, look back at your transactions and find the discrepancy.