Introduction

The Edge/QuickBooks integration posts aggregated sales and inventory data from The Edge to QuickBooks. It is our intent that The Edge be the sole “owner” of your customer and inventory details, but we understand that QuickBooks can better handle your accounting needs. In this arrangement, your QuickBooks company file will not contain any of your customer records, nor any single inventory item. The Edge posts General Ledger (G/L) entries for almost everything. In almost all cases, a full day’s activity is posted as a single G/L entry per account pair. It does not post “sales” per se. The sales reports in QuickBooks will not reflect sales handled by The Edge, but the profit/loss statement and balance sheet will accurately reflect all activity from both The Edge and QuickBooks. Cash taken in at POS will be aggregated and posted to a “cash on hand” account (e.g., undeposited funds), but checks and credit card payments will be posted as individual payments, and will appear as undeposited funds, so as to facilitate your bank deposits.

The Edge allows you to integrate features and map to your QuickBooks chart of accounts in a very flexible manner. It is required that every feature in The Edge be mapped to an appropriate account in your chart of accounts, even if you do not use this feature. This ensures all activity can be posted to QuickBooks, even if the feature is used some time in the future.

Nearly every QuickBooks user has a chart of accounts different than any other user. The design of your chart of accounts is a matter that you should discuss with your bookkeeper or, better yet, your accountant. You should design a chart of accounts that works for your unique business situation, and set up The Edge so that it posts to the G/L accounts that make sense for you.

You should be aware that The Edge WILL NOT do the following with QuickBooks:

You should be aware that The Edge WILL NOT do the following with QuickBooks:

- Transfer vendor or customer details to or from QuickBooks.

- Generate vendor bills. All bills must be entered manually into QuickBooks.

- Write checks. All checks must be written via QuickBooks.

- Transfer commission figures to QuickBooks. Commission calculations on The Edge are all “ad-hoc,” meaning that most jewelers will run commission reports several times, in several different ways, and sometimes make manual adjustments to the commissions due. Commission checks should be written via QuickBooks and possibly included in payroll checks.

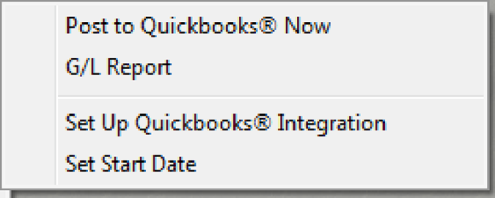

To work with QuickBooks and The Edge, select Administrative > QuickBooks®. A drop-down list of options will appear.

- Post to QB Now: This is how a store posts the pending transactions to QB (typically daily).

- GL Report: This is a report that shows detail or summary data in Debit/Credit format.

- Set Up QuickBooks Integration: This is where all the linkage between The Edge features/QuickBooks accounts are set.

- Set Start Date: This is where a store decides the From Date to post detail from The Edge to QuickBooks.

The following articles summarize Set Up and Important Operational notes, then explain Setup QuickBooks Integration in detail.