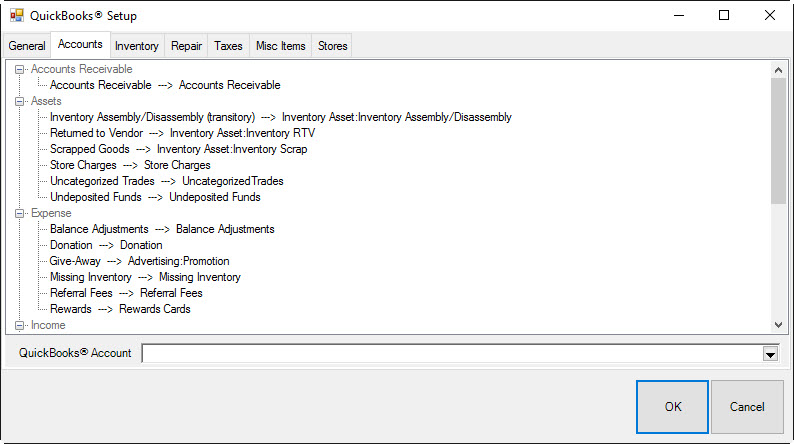

QuickBooks Accounts Tab

The Accounts tab contains a tree view of The Edge features organized by account type. These accounts must be mapped to a corresponding account in QuickBooks.

The following table outlines each account in The Edge and its use.

|

Accounts Receivable

|

|

Accounts Receivable

|

Set up this account to match QuickBooks’ default accounts receivable account. This is usually called “Accounts Receivable” but many users rename it to “Edge Pass-through Account.”

NOTE!

For purposes of data integration, The Edge uses the AR account as required pass-through. This account should not have a balance. Do not mistake the use of this account as store receivables.

|

|

|

Assets

|

|

Inventory Assembly/ Disassembly

|

|

This should be an asset account, and is used when assembling an item from other items, or breaking an item into several other items.

This account also serves as a transitory account for cost of inventory used in repair or custom jobs that are not yet picked up.

|

|

|

*Returned to Vendor

|

|

This should be an asset account, and is used when an item is marked “returned to vendor.” Understand that The Edge is finished with items that are marked RTV, so this posting moves the item value from your primary asset account to this temporary sub-asset account.

You will have to post your own G/L entries to move assets from this account to other accounts when you actually ship items back to the vendor, and/or when you receive credit or payment from the vendor for returned items.

|

|

|

*Scrapped Goods

|

|

This should be an asset account, and is used when an item is marked “scrapped.” Understand that The Edge is finished with items that are marked SCRAPPED, so this posting moves the item value from your primary asset account to this temporary sub-asset account.

You will have to post your own G/L entries to move assets from this account to other accounts when you determine the retained value of the scrapped goods, and how much to write off.

|

|

|

Store Charges

|

|

This should be an asset account, not a receivables account, and represents the amount of money people owe you on store charges (house account charges).

|

|

|

Uncategorized Trades

|

|

Used when accepting trades at POS with no category. There is a system option to assign categories and avoid use of this account.

|

|

|

Undeposited Funds

|

|

This feature must be mapped to the “Undeposited Funds” account created by QuickBooks for managing bank deposits. If you do not have this account presently in your chart of accounts, you must enable the feature in QuickBooks.

In QuickBooks, click Edit > Preferences > Payments > Company Preferences and check the option Use Undeposited Funds as a default deposit to account.”

|

|

|

Expense

|

|

Balance Adjustment

|

This should be an expense account. When you make an adjustment to a customer balance by selecting Adjust Balance from the Customer Balance tab, the difference is posted to this account. You can either create a new account for this purpose, or use an existing account, for example, bad debt write-offs.

|

|

|

|

|

Donation

|

This should be an expense account. When an item is marked as a donation at POS, the cost is debited here.

|

|

|

|

|

Giveaway

|

This should be an expense account. When an item is marked as a giveaway at POS, the cost is debited here.

|

|

|

*Missing Inventory

|

This should be an expense account. When you mark an item lost, stolen, or missing, the cost of that inventory is posted to this account. If an item is later marked “found,” the value of that item is recouped from this account.

|

|

|

Referral Fees

|

This should be an expense account. When you award referral bonuses, these fees are a form of advertising expense.

|

|

|

Rewards

|

This should be an expense account. When you provide reward dollars to customers, the rewards are a form of advertising expense.

|

|

|

Income

|

|

Appraisal Income

|

This should be an income account. The fees that you collect for performing appraisals will be posted to this account.

|

|

|

Fee Income

|

This should be an income account. Restocking fees charged for returns and cancellations will be posted to this account.

|

|

|

Interest Income

|

This should be an income account. Interest charges applied to store charge balances (house accounts) will be posted to this account.

|

|

|

Shipping Charges

|

This should be an income account. Money that you collect for shipping charges will be posted to this account.

NOTE!

Do not confuse this with a shipping expense account for fees incurred in store shipping and receiving.

|

|

|

Liabilities

|

|

|

Deposits (Money paid on account for the following)

|

|

|

|

|

Appraisal Deposits

|

This should be a liability account. Funds that customers leave on deposit with you while you are appraising their goods are posted to this account.

|

|

|

|

Layaway Deposits

|

This should be a liability account. Funds that customers leave on deposit with you to keep goods on layaway are posted to this account.

|

|

|

|

Memo Out Deposits

|

This should be a liability account. Funds that customers leave on deposit with you while they take goods out on approval are posted to this account.

|

|

|

|

Repair/Custom Deposits

|

This should be a liability account. Funds that customers leave on deposit with you while you are working on their repairs are posted to this account.

|

|

|

|

Special Order Deposits

|

This should be a liability account. Funds that customers leave on deposit with you while you are getting special order goods for them are posted to this account.

|

|

|

Gift Certificates

|

This should be a liability account. Funds that you have collected by selling gift certificates or tender cards will be posted to this account.

|

|

|

*Refunds Due

|

This should be a liability account. Funds that you need to return to customers will be posted to this account. For example, if you process a return to a customer by check, The Edge posts the check amount to this account.

When you write a refund check to a customer, charge it against this account.

Note that the general ledger will indicate (in the memo field) to which customers the refunds are due.

|

|

|

*Sales Tax Payable

|

This should be the actual QuickBooks “sales tax payable” account. Any sales tax that you collect will be posted here and will be payable to your tax agency. This will be depleted when you use “Pay Sales Tax” feature in QuickBooks.

|

|

|

Store Credits

|

This should be a liability account. Funds that you are holding in lieu of giving a customer a cash refund (this is also known as a credit memo) will be posted to this account.

|

NOTE: Inventory, Repair, and Miscellaneous Income accounts will be set on their respective tabs.